State-of-the-art management platform for insurer Precura: Dynamo

The insurance sector is in rapid evolution. Customers expect seamless digital services, regulators impose stricter requirements, and technological innovation follows one another faster than ever. In such a context, a company cannot afford outdated software or fragmented processes. At Metanous, we believe that successful digitalization starts with a well-thought-out management platform that forms the heart of the organization. With Dynamo, we built together with Precura — specialist in guaranteed income and revenue insurance for both groups and individuals — a modern, modular, and high-performing platform. It supports all core processes, from member management to compliance, while also providing the agility to smoothly embrace future evolutions in the sector. For Precura, Dynamo is not only an efficient work tool but also a solid digital foundation for further growth.

The challenge: transforming an outdated system into a future-proof platform

Precura operates in a demanding niche: safeguarding income and revenue in the event of incapacity for work, illness, or accident. This specialization comes with a wide range of products, conditions, and rates — each with its own lifecycle and exceptions. Before the project, digital operations relied on a system that was hard to scale and no longer able to handle growing product complexity. Many steps required manual intervention, integrations with accounting, customer portals, or external data sources were limited, and every change demanded disproportionate effort. At the same time, the pressure was mounting to report under new frameworks and to prepare for regulations emphasizing digital resilience and traceability. Precura needed a platform that could streamline processes, provide reliable integrations, and proactively meet compliance requirements — without slowing down the business.

The Metanous approach: modular, phased, and scalable

We began with an in-depth analysis: workshops with operational teams, product owners, and IT, complemented by a thorough review of existing data and integrations. Based on these insights, we designed a clear roadmap with domain-specific phases and well-defined milestones. From a technology standpoint, we chose .NET Core for the backend and Angular for the frontend — a combination that ensures performance, maintainability, and a strict separation of presentation and business logic. The architecture was deliberately designed to be modular: each core process received its own well-defined components, connected through clearly specified APIs. This allowed us to develop with focus, test more quickly, and deliver in phases. Our iterative approach enabled close feedback loops, allowing users to validate real-world scenarios from the very first releases and steadily mature the platform to production level.

Data migration: iterative, controlled, and auditable

The data migration track was crucial and fully integrated into the overall project approach. Instead of treating migration as a one-off final step, we allowed the data to evolve alongside Dynamo. All information from the legacy system — from member and policy data to claims histories, financial transactions, and relevant metadata — was fully transferred. More importantly, data was repeatedly loaded as modules stabilized. This iterative process allowed us to refine mappings, resolve interpretation differences, and continuously improve data quality. Each domain received unambiguous definitions with consistent keys, data types, and versioning, ensuring that historical records remained intact and could be reconstructed reproducibly.

On a technical level, we relied on repeatable migration scripts within a controlled data pipeline. Each load run generated detailed logs and reports, showing which records were transformed, which rules were applied, and where exceptions required manual follow-up. By combining interim load tests with targeted content sampling and reconciliations between source and target totals, we validated correctness both at record level and in aggregate. At the same time, Precura was able to work with its own, increasingly up-to-date data in the new environment during testing phases. This accelerated validation, surfaced exceptions early, and strengthened buy-in across the business.

Compliance and security were built into the development process from day one. Personal data was handled in full accordance with GDPR, with strict access controls and encryption where needed. From the perspective of the Digital Operational Resilience Act (DORA), the migration was designed with operational resilience in mind: scripts are repeatable, dependencies documented, and monitoring, error handling, and fallback scenarios are in place. Because audit trails were maintained at every step — including source values, transformation logic, and result statuses — it is always possible to demonstrate exactly how a specific data element evolved from source to target. The final switchover was therefore not a leap into the unknown, but the logical conclusion of a process that had already been executed multiple times incrementally. By the time of the definitive migration, mappings had been tested, controls were in place, and data quality was demonstrably up to standard — ensuring a smooth and confident go-live.

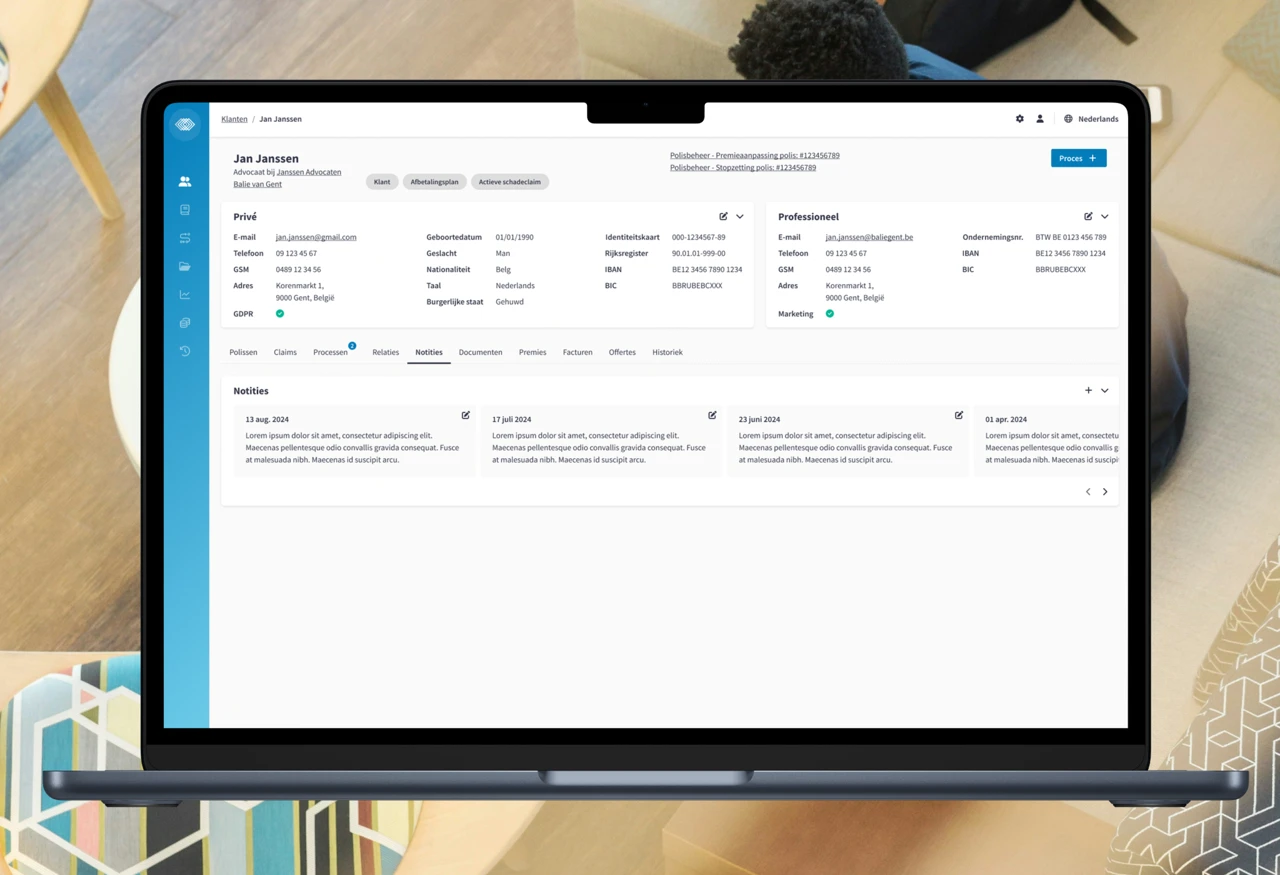

A management platform that covers every aspect of insurance

The strength of Dynamo lies in its comprehensive functional coverage across the entire insurance process. Member management is rebuilt around a central data structure that supports both individual enrollments and group policies. Data is centrally available with full history, and updates automatically trigger the right follow-up actions, such as recalculating premiums or sending correspondence. In policy management, Precura can flexibly configure products with varying coverage levels, waiting periods, and conditions. Changes are consistently applied while maintaining full history, and advanced calculation models determine pricing based on parameters such as age, occupation, or medical history.

For claims management, Dynamo introduces an end-to-end workflow: claims are handled digitally, transparently, and systematically. All communication, supporting documents, and medical records remain within a single case file, contextually available to every stakeholder in the claims process. The financial module is seamlessly integrated with policies and claims: premiums, payments, and reimbursements are automatically processed and accurately reported, without duplication of effort. Reporting and compliance play a central role: dashboards provide management insights, operational lists support day-to-day steering, and periodic reports make regulatory accountability efficient. With compliance in mind, audit trails, user roles, access controls, and data security are deeply embedded into the platform. Finally, Dynamo is open to the outside world: integrations with customer portals, validation services, and risk databases enable smooth data exchange and make the platform highly extensible.

Compliance as a driver of sustainability

Regulation is evolving rapidly and growing more complex. That’s why Dynamo is explicitly designed to accelerate compliance instead of slowing it down. For DORA, this means built-in traceability, incident logging, and role-based access, alongside repeatable and verifiable processes that ensure resilience against operational disruptions. For AWW-related requirements, the modular architecture provides the flexibility to implement changes quickly without destabilizing the rest of the system. And when it comes to GDPR, principles like data minimization, encryption, logging, and automated procedures for data subject rights are seamlessly embedded. The result is more than just compliance — it’s peace of mind: Precura can demonstrate what happens, why it happens, and who took which action — today, tomorrow, and well into the future.

Results: greater efficiency, reliability, and strategic agility

With Dynamo, Precura now works noticeably faster and more consistently. Automation reduces the risk of errors and shortens turnaround times, while the unified data layer simplifies internal collaboration. Employees can quickly find the right information, track changes more accurately, and focus on exceptions instead of repetitive tasks. Management benefits from real-time insights through dashboards and reports, enabling faster and more informed decision-making. Strategically, the platform provides the agility to launch new products, serve different customer segments, or add new services — without having to redesign the foundation each time. Thanks to built-in reporting, traceability, and security, Precura is also better positioned with regulators and partners. The combination of performance, data quality, and compliance creates a credible digital profile and lays the foundation for continued innovation.

Why insurers choose Metanous

This project illustrates how domain expertise and technical excellence reinforce each other. Metanous doesn’t build generic software with loose ends; we create solutions grounded in the realities of insurance: complex policy conditions, variable waiting periods, exceptions in claims management, the balance between speed and accuracy, and the need for demonstrable compliance. We work roadmap-driven, deliver in phases, and maintain a strict focus on quality, performance, and maintainability. This long-term vision results in a platform that delivers value today and scales for tomorrow — for the business, for IT, and for compliance.

Looking ahead: ready for the next sprint

Dynamo is not an endpoint, but a starting point. On the solid foundation in place, further innovations are a natural next step: more self-service options for customers and groups, mobile access to policy and claims data, advanced analytics, predictive models for pricing and claims, and AI-assisted tools where relevant for fraud detection or document recognition. Thanks to the modular architecture and robust integration layer, these enhancements can be added in a controlled manner without disrupting the stable core. In this way, the platform grows alongside Precura’s ambitions and the evolving expectations of the market.

Conclusion

With Dynamo, Precura now has a future-ready management platform that streamlines processes, ensures data quality, and accelerates compliance. The iterative data migration provided confidence during the final switchover and enabled a smooth start in the new environment. The chosen technology, modular architecture, and focus on auditability make the platform ready for the years ahead. For insurers facing similar challenges — outdated systems, increasing compliance pressure, and growing product complexity — this project demonstrates that a phased approach with a strong domain partner makes all the difference. Metanous is ready to be that partner.