Digital advantage in insurance

Metanous builds software that provides certainty — digital, secure, and future-proof. We combine technical expertise with industry knowledge to create high-performance solutions.

Powerful software for strong insurers

The insurance world is changing fast. New regulations, shifting customer behavior, digitalization, and efficiency pressures make agile solutions essential. At Metanous, we have years of experience building high-performance software for insurers, brokers, and wealth planners.

We help organizations automate processes, ensure compliance, and serve customers better digitally. With custom platforms integrated with existing systems, built on proven technology and enhanced with artificial intelligence.

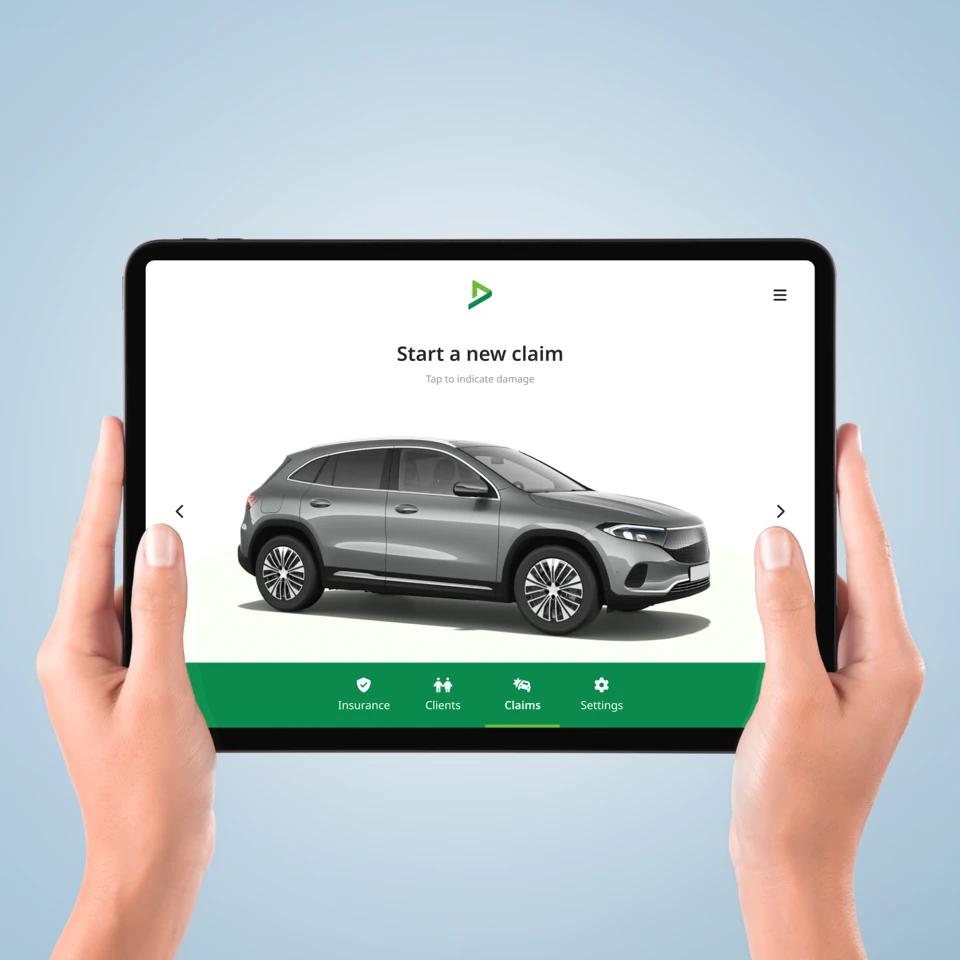

We have already developed solutions for policy management, claims management, wealth management, customer onboarding (KYC), anti-money laundering (AML), MiFID/IDD compliance, and digital data processing (GDPR).

Our solutions are not only legally up-to-date but also improve user experience and streamline internal processes. Think of digital vaults, KYC platforms, or tools for automated customer verification. This is how we translate complex regulations into intuitive and efficient applications.

Custom platform

Metanous has developed various management platforms tailored to insurers, each aligned with their processes, systems, and compliance requirements.

Internal & External

Modern platforms for case managers and back-office teams, as well as user-friendly digital portals for end customers.

Compliant with regulations

Know Your Customer (KYC), Anti-Money Laundering (AML), MiFID regulations (IDD), data protection (GDPR), security (DORA), etc.

High-performance and scalable

Smooth performance, even with increasing volumes or changing business processes.

Future-proof

Solutions that grow with your organization, are easily adaptable, and ready for what the future brings.

Our services: more than just code

Building software is just the beginning. What truly makes the difference is the knowledge, experience, and commitment we bring as a partner. At Metanous, we believe that a good solution only reaches its full potential when it is supported by a strong team — with expertise in both technology and the insurance sector.

Our experts are involved from day one, advising on process design, helping clarify decisions, and remaining available to adjust when needed. We use our experience to simplify complex challenges and translate them into solutions that work in the short and long term.

We don’t build one-off projects, but sustainable collaborations. This ensures that the software grows with your organization — securely, maintainably, and aligned with the reality of today and tomorrow.

Inspiration

Examples of platforms we recently built include: DORI, Precura, DEKRA. For each of these platforms, we are involved from concept to delivery, developing solutions that truly make a difference.

Custom technology — with expertise

At Metanous, we don’t build with no-code systems or closed platforms. We work with proven technologies (.NET, Azure, APIs, standards, ...) and keep everything transparent and extendable. No vendor lock-in. Full control.

We build with AI support while our experts remain in control, ensuring solutions stay manageable and maintainable.

👉 Read more about our approach to AI in software development

Why insurers choose Metanous

Industry insight & process knowledge

We speak the language of insurers, from compliance to customer engagement.Fast from idea to working solution

Thanks to our experience and methodology, we build quickly and thoughtfully.Sustainable solutions without dependencies

We build software that you understand, own, and can further expand.Long-term partnership

We believe in sustainable relationships, where we remain a reliable technical partner, continuously contributing to your evolution.

Software that makes insurance processes smarter and more efficient

From claims management to policy administration: we build solutions that automate workflows and enhance the customer experience.

Schedule a meeting